Banking dataset with a pymc model#

This notebook analyses historic data on banking closures from Richardson and Troost [2009] and used as a case study for a difference in differences analysis in the excellent book Mastering Metrics [Angrist and Pischke, 2014]. Here, we replicate this analysis, but using Bayesian inference.

import warnings

import arviz as az

import pandas as pd

import causalpy as cp

%load_ext autoreload

%autoreload 2

%config InlineBackend.figure_format = 'retina'

seed = 42

warnings.simplefilter(action="ignore", category=FutureWarning)

Load data#

The raw dataset has a date column which is just some uninterpretable number - all we need for our analysis is the year column. We also have columns bib6, bio6, bib8, bio8. We know that the 6 and 8 represent the 6th and 8th Federal Reserve districts, respectively. I assume bib means “banks in business”, so we’ll keep those columns. The data is at daily resolution, but we will convert this to yearly resolution. And from what I can tell from Figure 5.2 of Angrist and Pischke [2014], they seem to present the median number of banks open per year. Let’s load the data up and do those steps.

df = (

cp.load_data("banks")

# just keep columns we want

.filter(items=["bib6", "bib8", "year"])

# rename to meaningful variables

.rename(columns={"bib6": "Sixth District", "bib8": "Eighth District"})

# reduce from daily resolution to examine median banks open by year

.groupby("year")

.median()

)

treatment_time = 1930.5

# set treatment time to zero

df.index = df.index - treatment_time

treatment_time = 0

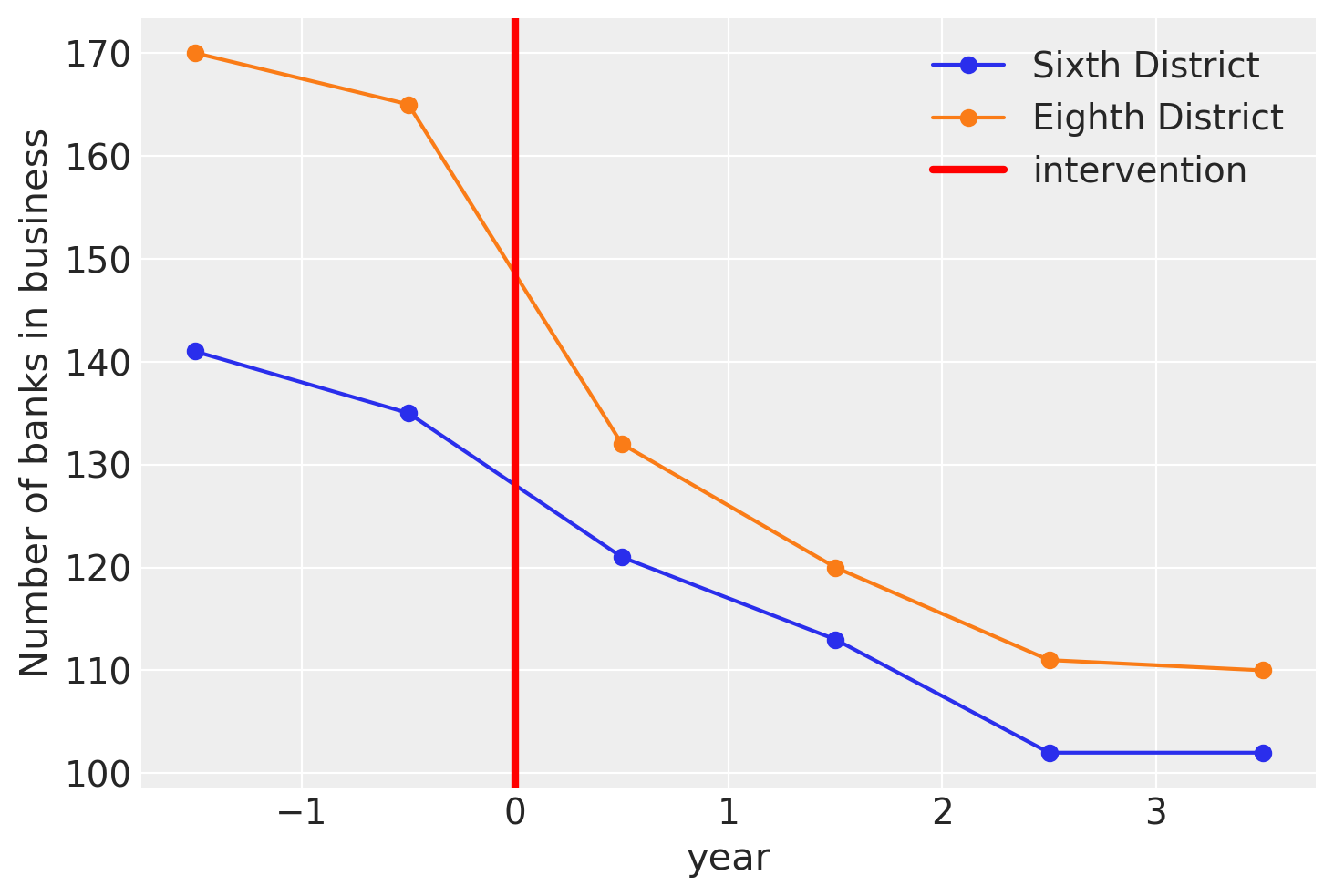

Let’s visualise what we have. This matches up exactly with Figure 5.2 of the Angrist and Pischke [2014].

ax = df[["Sixth District", "Eighth District"]].plot(style="o-")

ax.set(ylabel="Number of banks in business")

ax.axvline(x=treatment_time, c="r", lw=3, label="intervention")

ax.legend();

Just a few more final processing steps to make the data amenable to analysis. We will convert from wide form into long form. Then we will add a new column treated which indicates the observations where treatment has taken place.

df.reset_index(level=0, inplace=True)

df_long = (

pd.melt(

df,

id_vars=["year"],

value_vars=["Sixth District", "Eighth District"],

var_name="district",

value_name="bib",

)

.sort_values("year")

.reset_index()

)

# We also need to create a column called `unit` which labels each distinct

# unit. In our case we just have two treatment units (each district). So

# we can build a `unit` column from `district`.

df_long["unit"] = df_long["district"]

# We also need to create a `post_treatment` column to define times after

# the intervention.

df_long["post_treatment"] = df_long.year >= treatment_time

df_long

# Dummy coding for district

df_long = df_long.replace({"district": {"Sixth District": 1, "Eighth District": 0}})

df_long

| index | year | district | bib | unit | post_treatment | |

|---|---|---|---|---|---|---|

| 0 | 0 | -1.5 | 1 | 141.0 | Sixth District | False |

| 1 | 6 | -1.5 | 0 | 170.0 | Eighth District | False |

| 2 | 1 | -0.5 | 1 | 135.0 | Sixth District | False |

| 3 | 7 | -0.5 | 0 | 165.0 | Eighth District | False |

| 4 | 2 | 0.5 | 1 | 121.0 | Sixth District | True |

| 5 | 8 | 0.5 | 0 | 132.0 | Eighth District | True |

| 6 | 3 | 1.5 | 1 | 113.0 | Sixth District | True |

| 7 | 9 | 1.5 | 0 | 120.0 | Eighth District | True |

| 8 | 4 | 2.5 | 1 | 102.0 | Sixth District | True |

| 9 | 10 | 2.5 | 0 | 111.0 | Eighth District | True |

| 10 | 5 | 3.5 | 1 | 102.0 | Sixth District | True |

| 11 | 11 | 3.5 | 0 | 110.0 | Eighth District | True |

Analysis 1 - classic 2\(\times\)2 DiD#

First we’ll do an analysis just looking at data from 1930 and 1931. This way we just have a single pre-intervention and a single post-intervention measurement.

We will use the formula: bib ~ 1 + district * post_treatment which equates to the following model of expected values:

Let’s just run through this to make sure we understand:

\(\mu_i\) is the expected value of the outcome (number of banks in business) for the \(i^{th}\) observation.

\(\beta_0\) is an intercept term to capture the baseline number of banks in business of the control group, in the pre-intervention period.

districtis a dummy variable, so \(\beta_{d}\) will represent a main effect of district, that is any offset of the treatment group relative to the control group.post_treatmentis also a dummy variable which captures any shift in the outcome after the treatment time, regardless of the receiving treatment or not.the interaction of the two dummary variables

district:post_treatmentwill only take on values of 1 for the treatment group after the intervention. Therefore \(\beta_{\Delta}\) will represent our estimated causal effect.

result1 = cp.DifferenceInDifferences(

df_long[df_long.year.isin([-0.5, 0.5])],

formula="bib ~ 1 + district * post_treatment",

time_variable_name="post_treatment",

group_variable_name="district",

model=cp.pymc_models.LinearRegression(

sample_kwargs={"target_accept": 0.98, "random_seed": seed}

),

)

Show code cell output

Initializing NUTS using jitter+adapt_diag...

Multiprocess sampling (4 chains in 4 jobs)

NUTS: [beta, sigma]

Sampling 4 chains for 1_000 tune and 1_000 draw iterations (4_000 + 4_000 draws total) took 5 seconds.

There were 20 divergences after tuning. Increase `target_accept` or reparameterize.

The effective sample size per chain is smaller than 100 for some parameters. A higher number is needed for reliable rhat and ess computation. See https://arxiv.org/abs/1903.08008 for details

Sampling: [beta, sigma, y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Warning

We have some divergences here, which is a bad sign. This is likely related to the fact that we only have 4 data points but 5 parameters. This is not always a dealbreaker for a Bayesian analysis (because we have priors), nevertheless when we get divergent samples, this is a warning sign.

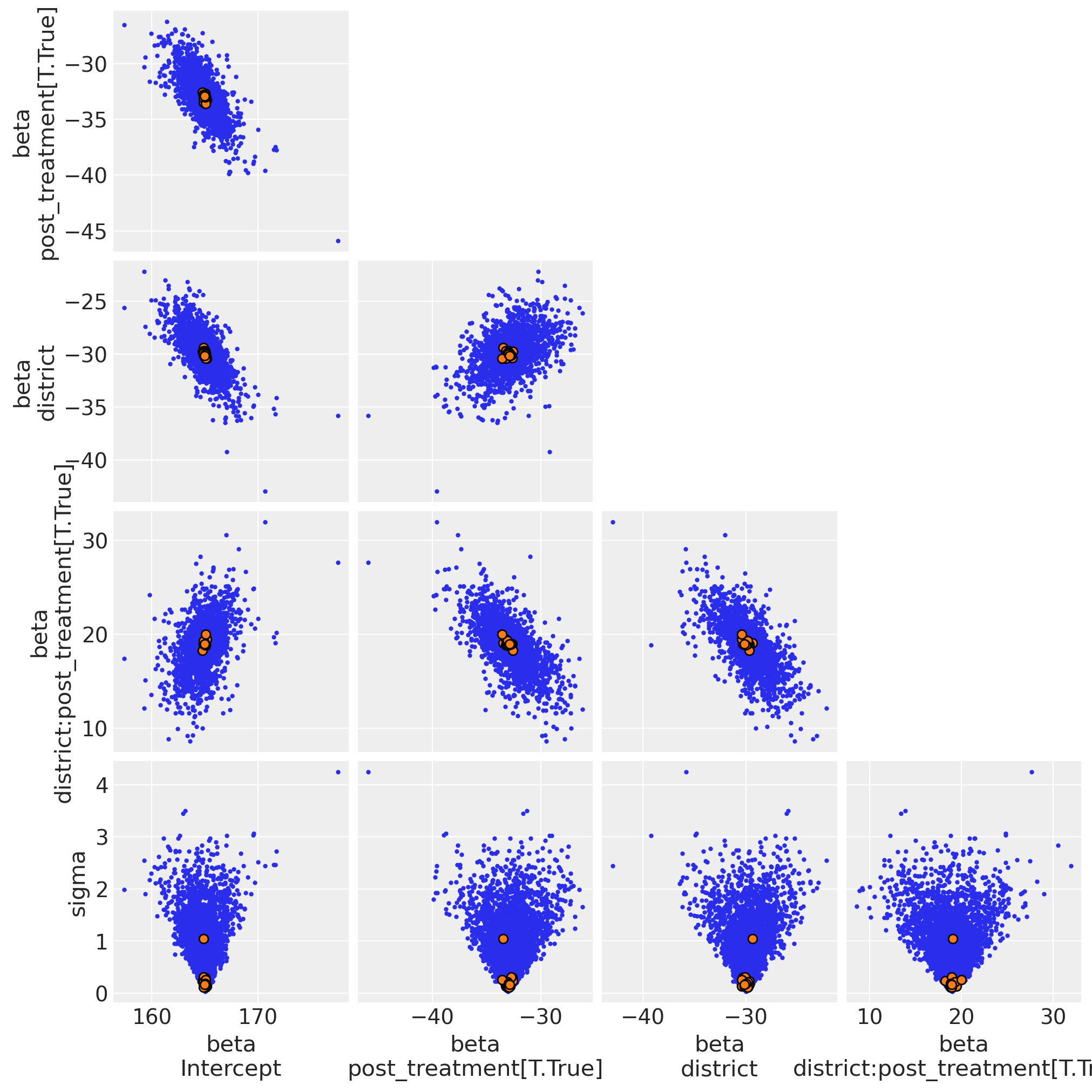

Using the following code, we can see that we have a classic “funnel problem” as the divergences occur when the sampler is exploring near zero values of the measurement error (the \(\sigma\) parameter). For ‘proper’ work, we’d want to fix things to avoid divergences by, for example, exploring different prior distributions for \(\sigma\).

You can visualise the divergences in the posterior samples like this:

az.plot_pair(result1.idata, var_names="~mu", divergences=True, figsize=(10, 10));

Show code cell output

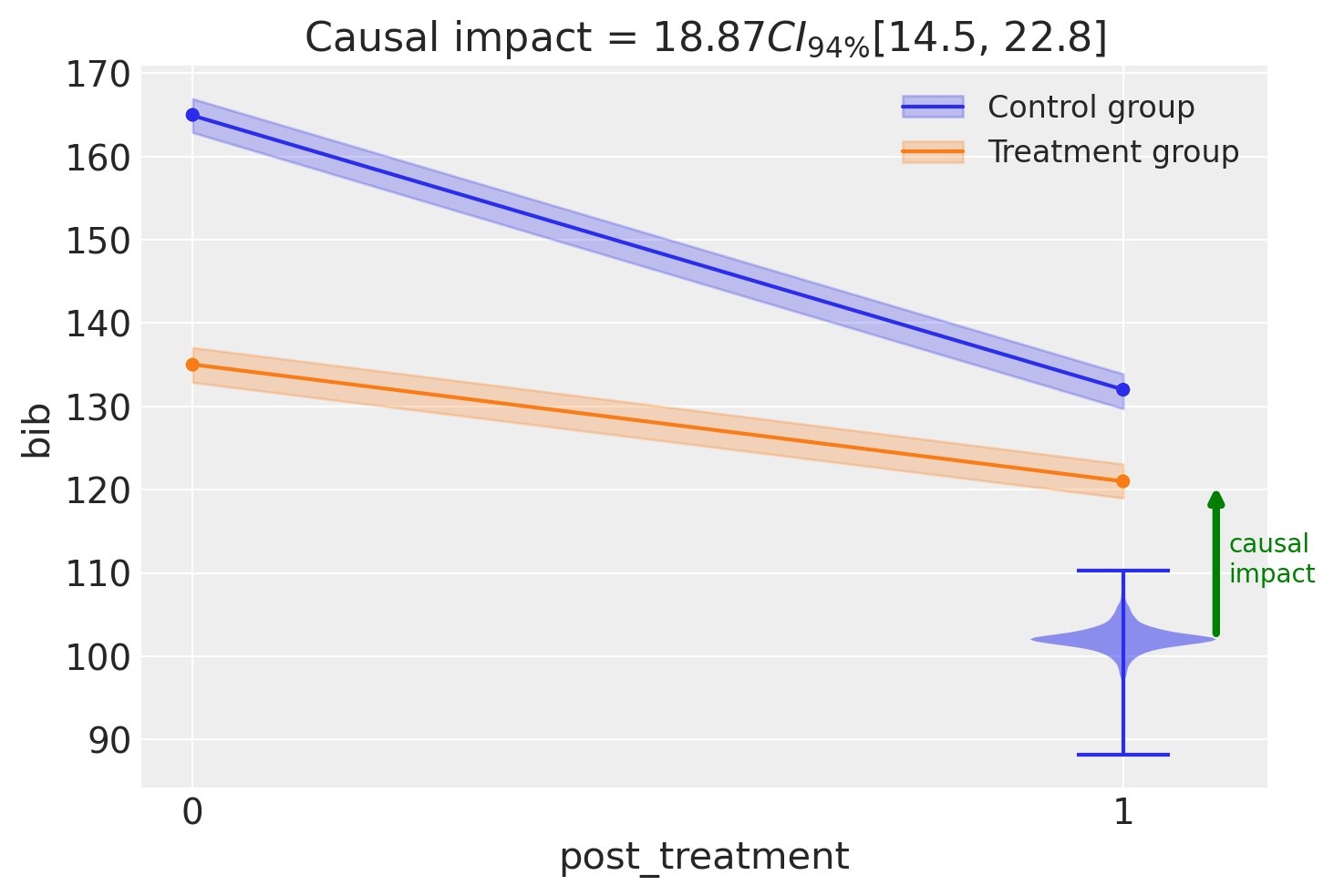

fig, ax = result1.plot(round_to=3)

result1.summary()

===========================Difference in Differences============================

Formula: bib ~ 1 + district * post_treatment

Results:

Causal impact = 18.87$CI_{94\%}$[15, 23]

Model coefficients:

Intercept 165, 94% HDI [163, 167]

post_treatment[T.True] -33, 94% HDI [-36, -30]

district -30, 94% HDI [-33, -27]

district:post_treatment[T.True] 19, 94% HDI [15, 23]

sigma 0.86, 94% HDI [0.16, 2.2]

Analysis 2 - same model, but with more data#

Now lets use the same model but provide observations of all years, not just the years immediately before and after the intervention. This will give us more data to work with.

result2 = cp.DifferenceInDifferences(

df_long,

formula="bib ~ 1 + district * post_treatment",

time_variable_name="post_treatment",

group_variable_name="district",

model=cp.pymc_models.LinearRegression(

sample_kwargs={"target_accept": 0.98, "random_seed": seed}

),

)

Show code cell output

Initializing NUTS using jitter+adapt_diag...

Multiprocess sampling (4 chains in 4 jobs)

NUTS: [beta, sigma]

Sampling 4 chains for 1_000 tune and 1_000 draw iterations (4_000 + 4_000 draws total) took 2 seconds.

Sampling: [beta, sigma, y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

result2.summary()

===========================Difference in Differences============================

Formula: bib ~ 1 + district * post_treatment

Results:

Causal impact = 19.27$CI_{94\%}$[8.7, 30]

Model coefficients:

Intercept 166, 94% HDI [160, 173]

post_treatment[T.True] -48, 94% HDI [-55, -40]

district -28, 94% HDI [-37, -19]

district:post_treatment[T.True] 19, 94% HDI [8.7, 30]

sigma 4.6, 94% HDI [3.9, 5.6]

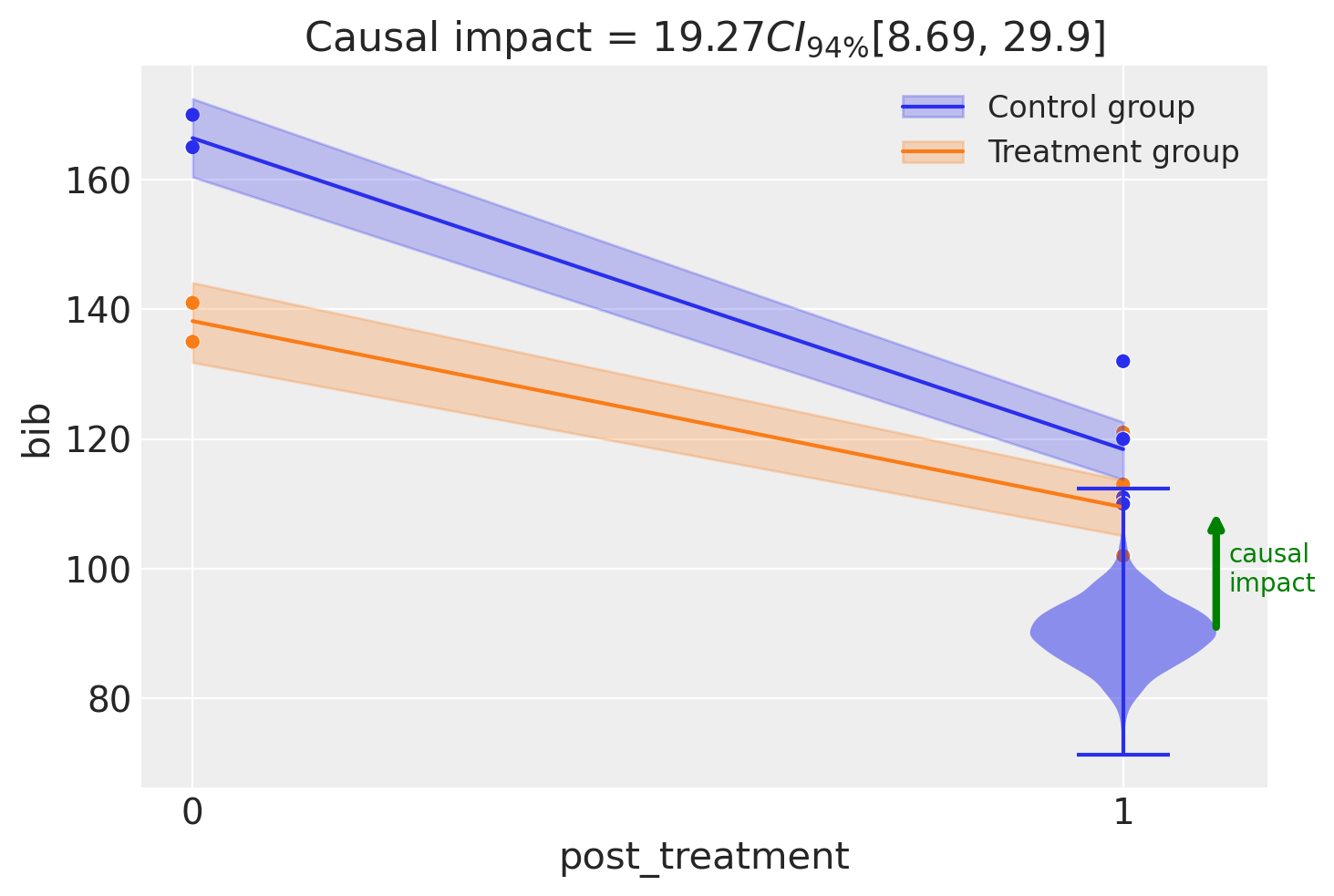

You can see form the table above that the inferred parameters are very similar to the results in [Angrist and Pischke, 2014] (p. 188). Any discrepancies are due to the fact that we have a Bayesian model with priors over the parameters.

fig, ax = result2.plot(round_to=3)

Let’s be clear about what is happening here. Both from the model equation and the plot above, we can see that the modeling approach is to simply pool all the pre intervention observations into the \(post=0\) group and all the post intervention observations into the \(post=1\) group. So we are essentially modeling the \(2\times 2\) group means (as we did before), but with more data per cell.

On the one hand, this could be considered a more robust analysis. But we can see from the raw data that there is a clear temporal trend in the data - the number of banks in business is decreasing over time. Simply averaging the data in pre or post groups will not account for this trend.

Analysis 3 - Modeling the temporal trend#

We’ll again do a difference in differences analysis of the full dataset. This approach has similarities to CITS (Comparative Interrupted Time-Series) with a single control over time. Although slightly arbitrary, we distinguish between the two techniques on whether there is enough time series data for CITS to capture the time series patterns.

We will use the formula: bib ~ 1 + year + district*post_treatment which equates to the following model of expected values:

The only change here compared to the classic 2\(\times\)2 DiD model above is the addition of a main effect of year. Because this is coded numerically (not categorically) this can capture any linear changes in the outcome variable over time.

result3 = cp.DifferenceInDifferences(

df_long,

formula="bib ~ 1 + year + district*post_treatment",

time_variable_name="year",

group_variable_name="district",

model=cp.pymc_models.LinearRegression(

sample_kwargs={"target_accept": 0.95, "random_seed": seed}

),

)

Show code cell output

Initializing NUTS using jitter+adapt_diag...

Multiprocess sampling (4 chains in 4 jobs)

NUTS: [beta, sigma]

Sampling 4 chains for 1_000 tune and 1_000 draw iterations (4_000 + 4_000 draws total) took 2 seconds.

Sampling: [beta, sigma, y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

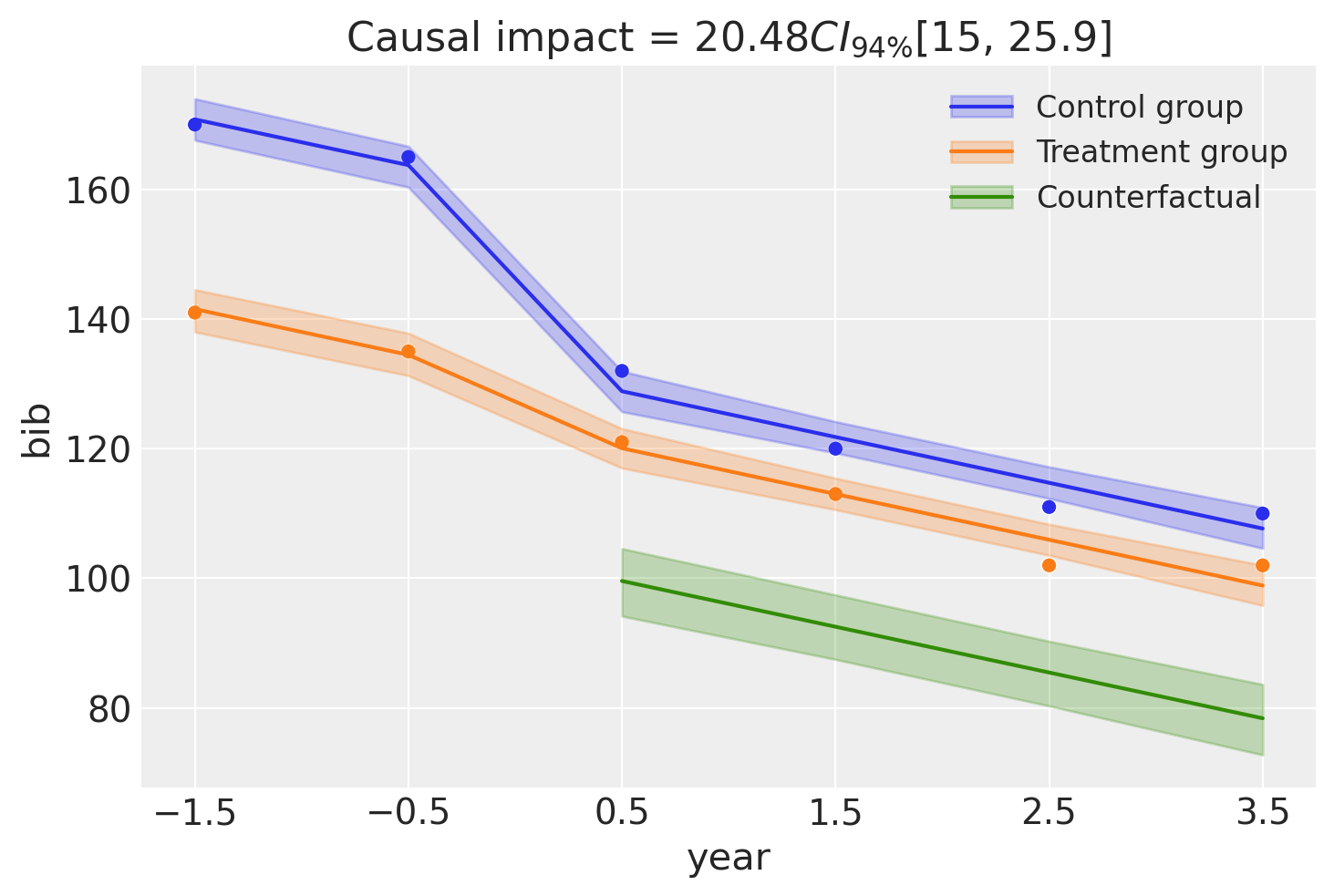

fig, ax = result3.plot(round_to=3)

Because we are now modeling time explicitly, we have year (relative to the intervention) on the x-axis. We can also see that the model clearly does a good job of capturing the temporal trend in the data.

result3.summary()

===========================Difference in Differences============================

Formula: bib ~ 1 + year + district*post_treatment

Results:

Causal impact = 20.48$CI_{94\%}$[15, 26]

Model coefficients:

Intercept 160, 94% HDI [157, 164]

post_treatment[T.True] -28, 94% HDI [-33, -22]

year -7.1, 94% HDI [-8.4, -5.7]

district -29, 94% HDI [-34, -25]

district:post_treatment[T.True] 20, 94% HDI [15, 26]

sigma 2.4, 94% HDI [1.7, 3.2]

By looking at the interaction term, which captures the causal impact of the intervention, we can see that it looks like about 20 banks were saved by the intervention. Though there is some uncertainty around this, we can see the full posterior estimate of this impact below.

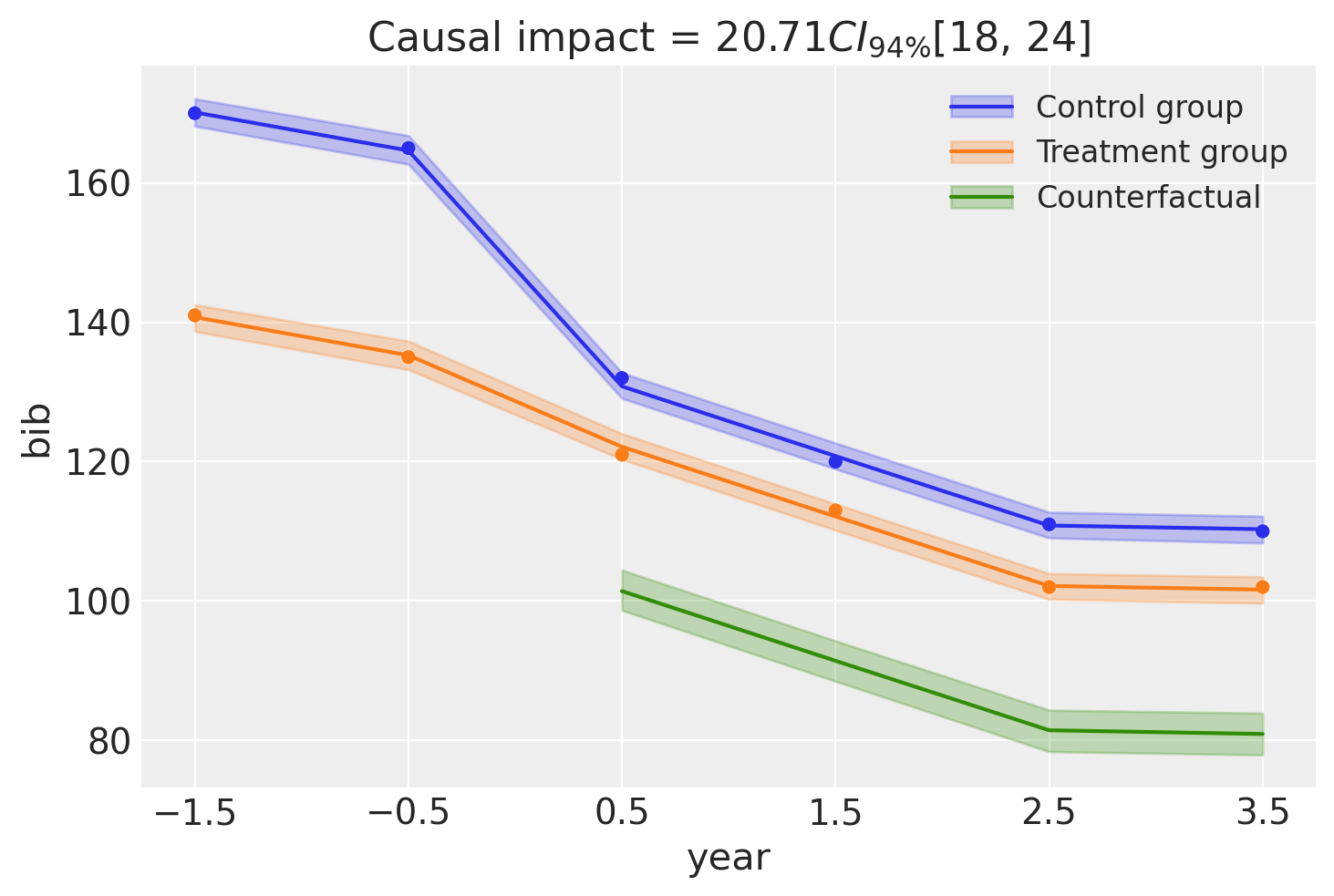

Analysis 4 - Two-way fixed effects#

Finally, we can evaluate the difference-in-differences model in its two-way fixed effects (TWFE) formulation. The TWFE model is widely used in econometrics for causal inference in panel data. It accounts for both unit-specific effects (e.g., differences between districts) and time-specific effects (e.g., shocks or trends affecting all units simultaneously).

The TWFE model is equivalent to the classic 2\(\times\)2 DiD model (Model 1) only in the special case of two groups and two time periods. Outside of this case the approaches diverge, and TWFE can have important limitations [Hill et al., 2020, Imai and Kim, 2021]. Readers should proceed with caution when applying TWFE in richer settings [Kropko and Kubinec, 2018, Collischon and Eberl, 2020].

The TWFE approach is similar to the previous model in that the district:post_treatment interaction term still defines a treatment indicator variable, and its coefficient \(\Delta\) represents the causal effect of the intervention. The difference is that there is no linear year term, instead we use a categorical year variable. This allows the model to flexibly capture any time-specific shocks that affect all units.

The expected values can be written as:

Here:

\(\gamma\) is a scalar global intercept.

\(\alpha[\text{district}_i]\) is a vector of unit (district) fixed effects. With 2 districts, this is a vector of length 2. The index \(\text{district}_i\) selects the effect for the \(i^{\text{th}}\) observation.

\(\beta[\text{year}_i]\) is a vector of time (year) fixed effects. With 6 years, this is a vector of length 6. The index \(\text{year}_i\) selects the effect for the \(i^{\text{th}}\) observation.

\(\Delta\) is a scalar treatment effect, corresponding to the coefficient on the

district:post_treatmentinteraction term.

result_twfe = cp.DifferenceInDifferences(

df_long,

formula="bib ~ 0 + district + C(year) + district:post_treatment",

time_variable_name="year",

group_variable_name="district",

model=cp.pymc_models.LinearRegression(

sample_kwargs={"target_accept": 0.95, "random_seed": seed}

),

)

# TODO: ideally we would be able to use `unit` instead of `district`

Show code cell output

Initializing NUTS using jitter+adapt_diag...

Multiprocess sampling (4 chains in 4 jobs)

NUTS: [beta, sigma]

Sampling 4 chains for 1_000 tune and 1_000 draw iterations (4_000 + 4_000 draws total) took 1 seconds.

Sampling: [beta, sigma, y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

Sampling: [y_hat]

result_twfe.plot();

result_twfe.summary()

===========================Difference in Differences============================

Formula: bib ~ 0 + district + C(year) + district:post_treatment

Results:

Causal impact = 20.71$CI_{94\%}$[18, 24]

Model coefficients:

C(year)[-1.5] 170, 94% HDI [168, 172]

C(year)[-0.5] 165, 94% HDI [163, 167]

C(year)[0.5] 131, 94% HDI [129, 133]

C(year)[1.5] 121, 94% HDI [119, 123]

C(year)[2.5] 111, 94% HDI [109, 113]

C(year)[3.5] 110, 94% HDI [108, 112]

district -29, 94% HDI [-32, -27]

district:post_treatment[T.True] 21, 94% HDI [18, 24]

sigma 1.2, 94% HDI [0.64, 2]

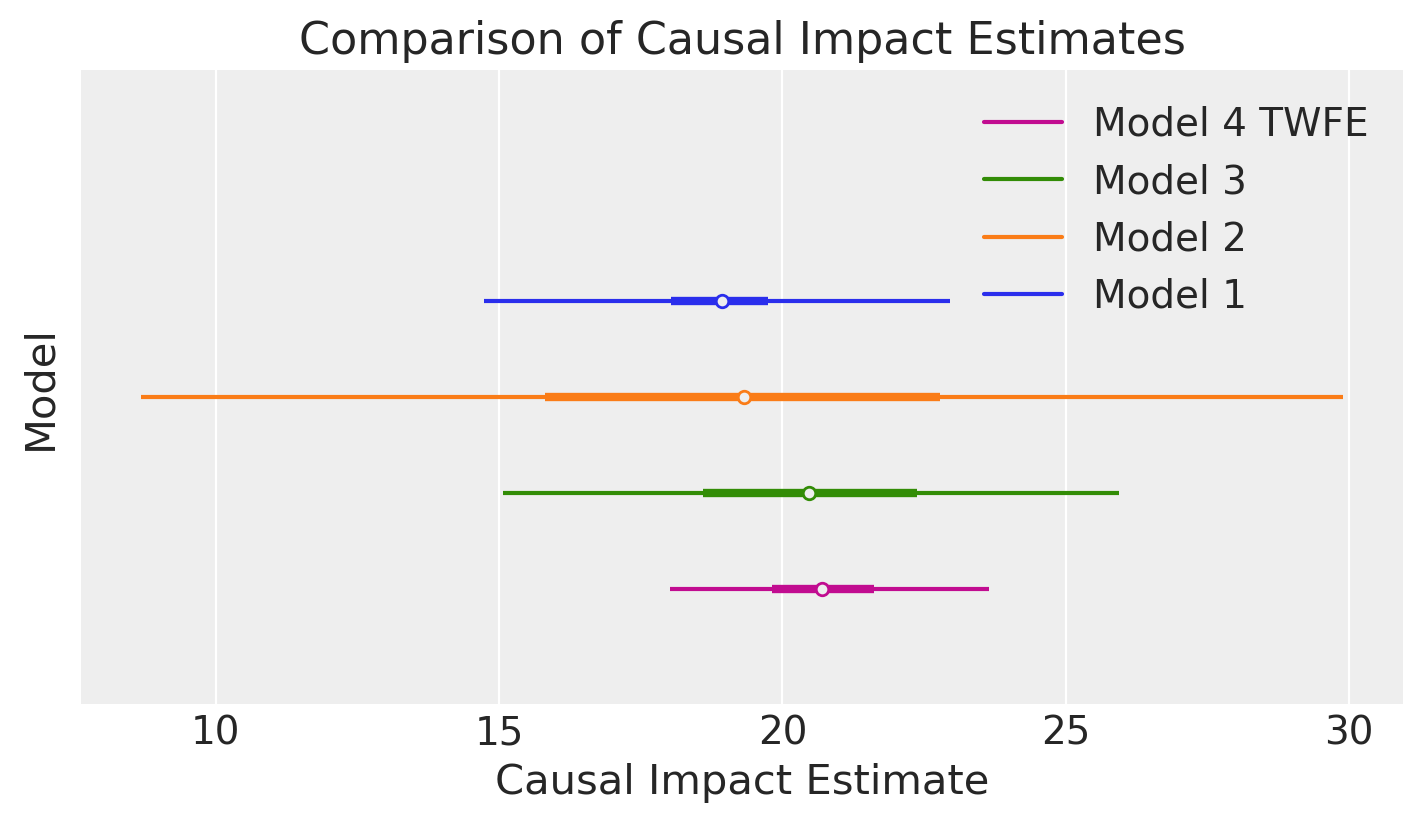

Comparison of the estimated causal effect#

We can compare the posterior mean and precision of the estimated causal effect from the three analyses above.

Show code cell source

ax = az.plot_forest(

[

result1.causal_impact,

result2.causal_impact,

result3.causal_impact,

result_twfe.causal_impact,

],

model_names=["Model 1", "Model 2", "Model 3", "Model 4 TWFE"],

combined=True,

figsize=(7, 4),

hdi_prob=0.94,

)

ax[0].set(

title="Comparison of Causal Impact Estimates",

xlabel="Causal Impact Estimate",

ylabel="Model",

yticklabels="",

);

We can see that Model 3 (which models the temporal trend) gives a more precise estimate of the causal effect than Model 2 (which simply pools the pre and post intervention data).

In turn, Model 4 (the two-way fixed effects model) gives a more precise estimate than Model 3. This is because Model 3 assumes a linear trend - but looking at the data we can see that the final observation deviates a bit from a linear trend. The two-way fixed effects model can capture any time-based shocks that affect all units, which is not possible in the previous models. Though it does so at the cost of increased numbers of model parameters.

Warning

The estimate from Model 1 should currently be considered as unreliable. This will be improved in the near future.

References#

Gary Richardson and William Troost. Monetary intervention mitigated banking panics during the great depression: quasi-experimental evidence from a federal reserve district border, 1929–1933. Journal of Political Economy, 117(6):1031–1073, 2009.

Joshua D Angrist and Jörn-Steffen Pischke. Mastering 'Metrics: The path from cause to effect. Princeton University Press, 2014.

Terrence D Hill, Andrew P Davis, J Micah Roos, and Michael T French. Limitations of fixed-effects models for panel data. Sociological Perspectives, 63(3):357–369, 2020.

Kosuke Imai and In Song Kim. On the use of two-way fixed effects regression models for causal inference with panel data. Political Analysis, 29(3):405–415, 2021.

Jonathan Kropko and Robert Kubinec. Why the two-way fixed effects model is difficult to interpret, and what to do about it. Kropko J, Kubinec R (2020) Interpretation and identification of within-unit and cross-sectional variation in panel data models. PLoS ONE, 15(4):e0231349, 2018.

Matthias Collischon and Andreas Eberl. Let's talk about fixed effects: let's talk about all the good things and the bad things. KZfSS Kölner Zeitschrift für Soziologie und Sozialpsychologie, 72(2):289–299, 2020.